Most people assume their estate plan will work when it’s needed. Then a medical emergency or sudden death happens, and the gaps show up fast. Documents are missing. Beneficiaries are outdated. Property gets tied up in court while families wait and costs quietly add up.

These outcomes don’t happen because families failed to care. They happen because of common estate planning mistakes to avoid that go unnoticed for years. By the time problems surface, fixing them is harder, slower, and more expensive.

I work with families who want answers before problems surface. This article explains where estate plans most often break down and how addressing those issues early can prevent unnecessary stress later.

Why Estate Planning Matters More Than You Think

Estate planning serves a practical purpose for individuals and families at every income level. It establishes who will manage assets, care for minor children, and make decisions if incapacity or death occurs.

Without these instructions, state law determines those outcomes, often in ways that do not reflect personal intent.

The legal and financial consequences of failing to plan are significant. A majority of Americans still die without a will, which typically requires probate administration.

Probate frequently involves court supervision, statutory fees that can total several percentage points of the estate’s value, and delays that may prevent beneficiaries from accessing property for many months.

Most estate planning problems do not arise from complexity. They result from inaction, outdated documents, or reliance on informal or incomplete planning. Understanding the function of an estate plan is essential to avoiding unnecessary cost, delay, and administrative burden.

Top 10 Estate Planning Mistakes to Avoid

Below are the most common estate planning mistakes, explained in plain terms. Each one shows how small gaps can create larger legal and financial problems later.

Mistake 1: Failing to Create Any Plan

Many people delay estate planning because it feels uncomfortable or easy to postpone. Without a will or trust, state law determines who receives your property and who can make decisions for minor children. These default rules often do not match personal wishes, especially for unmarried couples or blended families.

Creating even a basic plan allows you to name decision-makers and reduce court involvement.

Mistake 2: Never Updating After Life Changes

Estate plans need to change as life changes. Divorce, remarriage, new children, deaths, or a move to another state can all affect how documents operate. When plans are not updated, assets may go to unintended people or fail to reflect current family needs.

Regular reviews help keep documents aligned with your present situation.

Mistake 3: Ignoring Beneficiary Designations

Beneficiary designations on retirement accounts, life insurance, and some bank accounts override the instructions in a will. If these forms are outdated or incomplete, assets may pass to former spouses or minor children without proper safeguards.

Reviewing beneficiary designations alongside your estate plan helps prevent these conflicts.

Mistake 4: Creating a Trust but Not Funding It

A trust only works if assets are transferred into it. If property remains titled in your individual name, probate may still be required even though a trust exists. Retitling assets into the trust is a necessary step to ensure the trust functions as intended.

Mistake 5: Ignoring Digital Assets

Digital assets include online accounts, cryptocurrency, stored photos, and digital businesses. According to legal resources, heirs often can’t access digital accounts after death unless explicit permission is granted in advance.

Listing digital assets and granting fiduciary access helps preserve both financial and personal information.

Mistake 6: Choosing the Wrong Executor or Trustee

An executor or trustee is responsible for managing and distributing assets. Choosing someone based only on family position can lead to delays or disputes if that person lacks time, organization, or neutrality.

Selecting capable individuals and naming backups helps the process run more smoothly.

Mistake 7: Overlooking Tax Planning Issues

Even when estate taxes are not an immediate concern, missed planning opportunities can increase costs for heirs. Poor coordination between spouses or failure to address state-level taxes can reduce the value of the estate.

Basic tax planning helps minimize unnecessary financial loss.

Mistake 8: Relying Entirely on Do-It-Yourself Documents

Online estate planning tools often do not account for state-specific requirements or complex family situations. Improper execution or missing provisions can cause documents to fail when they are needed most.

Professional review helps ensure documents are valid and effective.

Mistake 9: Failing to Plan for Incapacity

Estate planning also covers situations where someone is alive but unable to make decisions. Without durable powers of attorney and healthcare directives, courts may need to appoint someone to act on your behalf.

Planning for incapacity allows trusted individuals to step in without court involvement.

Mistake 10: Overlooking Special Family or Financial Situations

Certain situations require additional planning, such as blended families, beneficiaries with disabilities, or long-term care concerns. Standard documents may unintentionally exclude stepchildren or interfere with public benefits.

Tailored planning helps address these circumstances while protecting everyone involved.

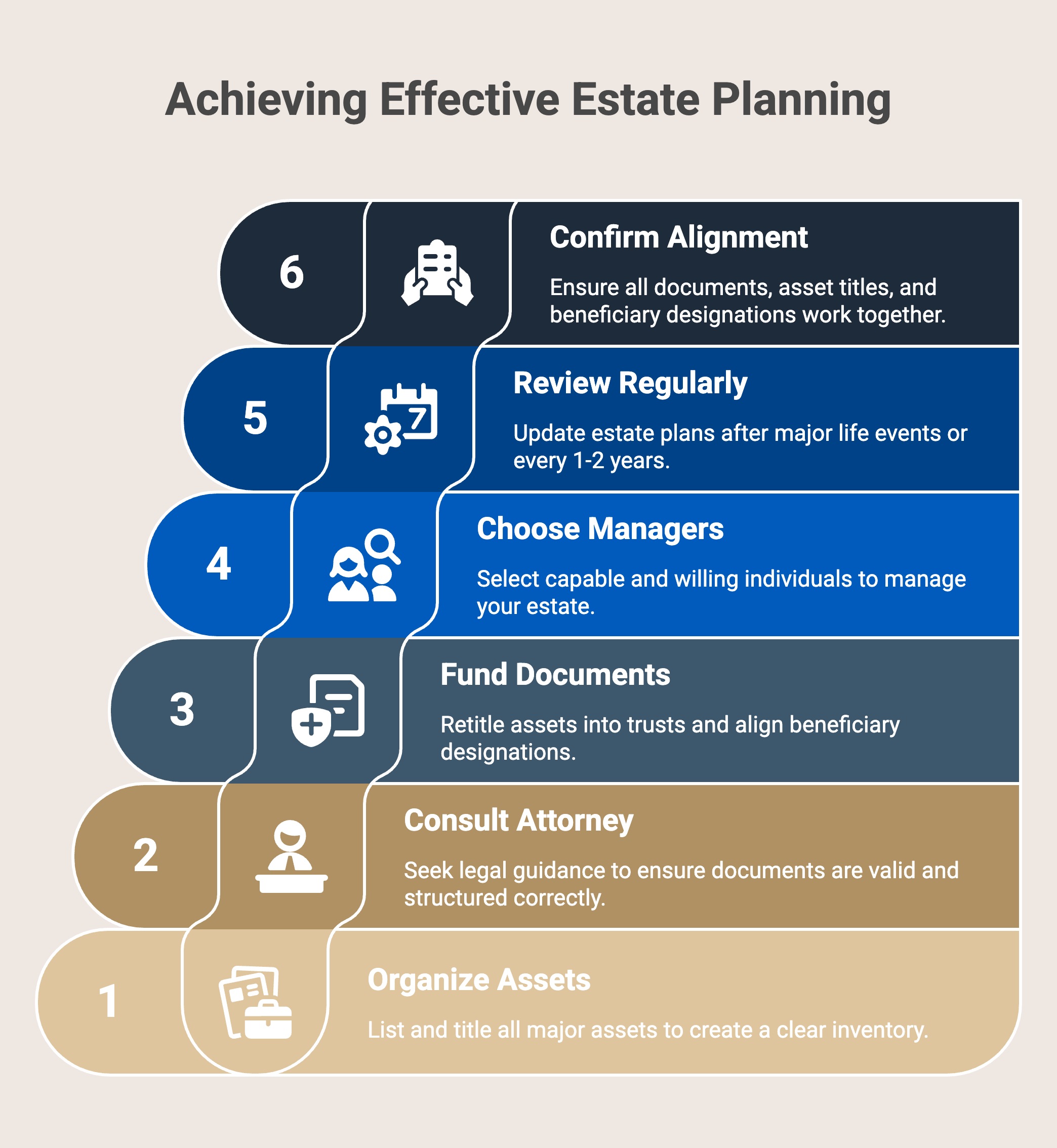

Simple Steps to Fix Estate Planning Mistakes

Most estate planning problems are not complex. They usually come from missed steps, poor coordination, or documents that were never reviewed together. Following a clear sequence helps prevent those breakdowns.

1. Start With a Complete Inventory

Begin by listing your major assets, how each one is titled, and any beneficiary designations. This includes real estate, bank and investment accounts, retirement plans, insurance policies, and digital assets.

A full inventory creates a clear starting point and makes gaps or inconsistencies easier to spot.

2. Work With an Estate Planning Attorney

Estate planning laws vary by state, and small drafting or execution errors can cause documents to fail. An estate planning attorney helps ensure documents are legally valid and structured correctly from the beginning.

Professional guidance also helps identify planning issues that are easy to overlook, such as incapacity gaps, tax elections, or conflicts between documents.

3. Fund and Coordinate Your Documents

Trusts must be properly funded to function as intended. Assets should be retitled into the trust where appropriate, and beneficiary designations should align with the overall plan.

Coordination between documents reduces the risk of probate, delays, and conflicting instructions.

4. Choose the Right People to Manage Your Estate

Executors, trustees, and agents should be selected based on ability, availability, and willingness to serve. These roles involve responsibility and time, not just family ties.

Discussing expectations in advance and naming backup fiduciaries helps avoid delays if the first choice cannot serve.

5. Review and Update Regularly

Estate plans should be reviewed after major life events such as marriage, divorce, births, deaths, or relocation. Even without changes, a review every one to two years helps keep documents current.

Regular reviews prevent outdated instructions from creating unintended outcomes.

6. Confirm Everything Works Together

A final review ensures documents, asset titles, and beneficiary designations align. This step often uncovers minor issues that can be corrected quickly.

Addressing these issues early is far less costly and disruptive than resolving them after a medical emergency or death.

When Planning Is Done Right

Estate planning works best when it is done early, reviewed regularly, and kept coordinated as life changes. Most problems do not come from complicated estates, but from small gaps that are easy to overlook.

Being aware of common estate planning mistakes to avoid gives families the opportunity to address issues before they surface. With a complete and current plan in place, decisions stay private, intentions are clear, and loved ones are spared unnecessary complications.

For guidance reviewing your current estate plan or addressing potential gaps, contact us today to discuss next steps.

Frequently Asked Questions

Do I really need an estate plan if I don’t have many assets?

Yes. Estate planning is not only about wealth. It determines who can make decisions for you, who receives personal property, and who cares for minor children. Without a plan, state law controls these outcomes, which may not reflect your wishes or family situation.

How often should I review my estate plan?

Most estate plans should be reviewed every one to two years, and sooner after major life changes. Marriage, divorce, births, deaths, or moving to a new state can affect how documents operate. Regular reviews help ensure instructions remain accurate and legally effective.

Can beneficiary designations override my will?

Yes. Beneficiary designations on retirement accounts, life insurance, and some financial accounts control how those assets pass, regardless of what a will says. If these forms are outdated or inconsistent, assets may go to unintended recipients, even when a will exists.

What happens if my trust is not properly funded?

If assets are not transferred into a trust, they may still be subject to probate. A trust only controls property titled in its name. Funding the trust by retitling assets is essential for probate avoidance and for the trust to function as intended.

Why is incapacity planning part of estate planning?

Estate planning also addresses situations where you are alive but unable to make decisions. Without durable powers of attorney or healthcare directives, courts may appoint someone to act for you. Incapacity planning allows trusted individuals to step in without court involvement.

0 Comments