When people begin estate planning, many assume all trusts work the same way. That assumption often leads to plans that feel right at the time but create limits, tax exposure, or loss of control later.

The consequences usually appear years down the line. A trust that is too rigid can restrict access to assets. One that is too flexible may fail to protect them. By the time the problem becomes clear, changing course can be difficult or impossible.

Understanding the irrevocable trust vs revocable trust differences helps clarify what control you keep, what protection applies, and how assets are treated over time. Learning how these structures work before documents are signed gives you more room to make informed decisions.

This guide explains how each trust functions, where the trade-offs exist, and what to consider before choosing one structure over the other.

What Is a Revocable Trust?

A revocable trust, often called a living trust, is an estate planning tool that allows you to place assets into a trust while keeping control during your lifetime. You can change the trust, add or remove assets, or revoke it entirely as circumstances change.

Because you typically serve as the initial trustee, you continue managing the assets just as you did before. You can buy, sell, or retitle property without court involvement, and day-to-day ownership usually feels the same.

After death, a revocable trust becomes irrevocable. A successor trustee then follows the instructions in the trust to distribute assets privately, without going through probate.

As explained by the Colorado Bar Association, revocable trusts allow ongoing control and probate avoidance but do not provide creditor protection or remove assets from the taxable estate.

What Is an Irrevocable Trust?

An irrevocable trust is a trust where assets are transferred out of your personal ownership and into the trust. Once it is created and funded, changes are limited and usually cannot be made without court approval or trustee consent.

Because the assets no longer belong to you personally, they are generally removed from your estate. This structure is commonly used for estate tax planning, asset protection, or long-term care planning, especially when protection is more important than flexibility.

Irrevocable trusts can help shield assets from certain creditors, lawsuits, or future long-term care costs after required waiting periods. These protections depend on how the trust is drafted and when assets are transferred, which makes timing an important factor.

The primary benefit of an irrevocable trust is protection. The primary trade-off is loss of control, since assets placed in the trust generally cannot be taken back or easily changed once transferred.

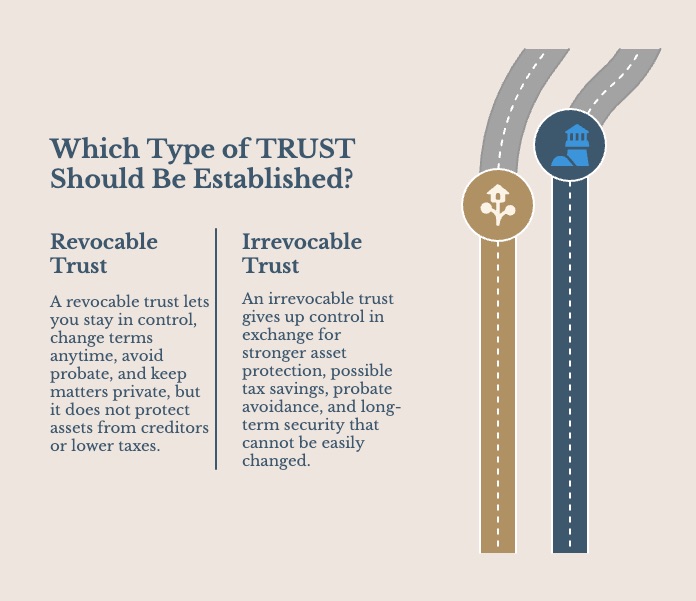

Irrevocable Trust Vs Revocable Trust

Revocable and irrevocable trusts address different planning goals. The distinctions between them affect flexibility, control, and long-term outcomes.

1. Flexibility

Revocable trusts are designed to change over time. You can amend the trust, add or remove assets, or revoke it entirely as circumstances shift.

Irrevocable trusts are meant to stay in place. Once assets are transferred, changes are limited and often require trustee consent or court involvement. This permanence requires more planning upfront.

2. Control Over Assets

With a revocable trust, you typically remain in control. As trustee, you continue managing assets and making decisions just as you did before.

An irrevocable trust transfers control to a trustee. While this reduces your direct involvement, it is what allows the trust to provide stronger protection.

3. Probate Avoidance

Both revocable and irrevocable trusts generally avoid probate when properly funded. Assets are distributed according to the trust terms without court supervision. This allows for private administration and fewer delays compared to court-managed estate settlement.

4. Asset Protection

Revocable trust assets are usually treated as your personal property. As a result, they remain exposed to creditors and legal claims.

Irrevocable trusts offer stronger protection. Because the assets are no longer owned by you personally, they are often shielded from creditors, lawsuits, and certain claims, depending on timing and structure.

5. Tax Treatment

Revocable trusts do not remove assets from your taxable estate. For tax purposes, the assets are still treated as yours.

Irrevocable trusts may remove assets from the estate, which can reduce estate tax exposure. This benefit depends on how the trust is funded and whether required rules and waiting periods are met.

6. Privacy

Both trust types provide privacy. Unlike probate, trust administration does not create public court records. This keeps financial details and family decisions out of public view.

7. Cost and Administration

Revocable trusts are generally less expensive to set up and manage. They typically involve lower upfront costs and minimal ongoing administration.

Irrevocable trusts usually require higher setup costs and ongoing administration. Because of their complexity and permanence, they often involve trustee fees and additional oversight.

Pros and Cons of Revocable and Irrevocable Trusts

Reviewing the remaining advantages and limitations helps surface practical considerations that are not always obvious at the start of planning.

Revocable Trusts

Pros

- Easier to manage alongside everyday finances

- Fewer ongoing requirements while you are alive

- Less paperwork during your lifetime

Cons

- Limited use for long-term protection planning

- May not meet goals tied to taxes or asset protection

Irrevocable Trusts

Pros

- Better suited for long-term planning goals

- Can support planning across generations

- Separates who manages assets from who benefits

Cons

- Hard to fix mistakes once assets are transferred

- Trustee choice matters and can be difficult to change

- Less flexibility if circumstances change

When to Choose Revocable Vs Irrevocable

Choosing between a revocable trust and an irrevocable trust depends on priorities. Flexibility and ongoing control tend to point in one direction, while protection and long-term planning often point in the other.

A revocable trust is usually appropriate when circumstances may change, such as:

- Assets or income that are still evolving

- Beneficiaries who may change over time

- A need to retain control and easy access to property

- Preference for flexibility over long-term protection

An irrevocable trust is typically considered when long-term protection is the goal, including:

- Estate tax planning concerns

- Asset protection from creditors or lawsuits

- Planning for future long-term care or Medicaid eligibility

- Willingness to give up control in exchange for stability

Other factors also influence the decision. Age, health, family dynamics, risk exposure, and estate size all play a role.

Vanguard’s estate planning guide emphasizes that estate plans should be built around individual goals, family situations, asset types, and future planning needs rather than a one-size-fits-all approach.

Selecting a Trust Structure That Fits

Comparing the irrevocable trust vs revocable trust differences clarifies how control, protection, and flexibility operate over time. Each structure serves a specific purpose, and the right choice depends on long-term priorities rather than short-term convenience.

Taking the time to review these differences before documents are finalized can prevent limitations that are difficult to change later. Clear planning allows trust structures to support, rather than complicate, future decisions.

If you are considering these options and want clear, practical guidance, contact us today to review the process and next steps.

Frequently Asked Questions

Can I change a revocable trust after it is created?

Yes. A revocable trust can be changed, updated, or canceled during your lifetime. You can adjust beneficiaries, move assets in or out, or revise instructions as circumstances change. This flexibility is one of the main reasons revocable trusts are commonly used in estate planning.

Can an irrevocable trust ever be changed?

In most cases, changes to an irrevocable trust are very limited. Some adjustments may be possible with court approval or trustee consent, but this depends on the trust terms and state law. Because changes are difficult, irrevocable trusts require careful planning before assets are transferred.

Do trusts replace the need for a will?

A trust does not fully replace a will. Most estate plans include a pour-over will to address assets not transferred into the trust. The will acts as a backup, directing remaining assets into the trust so the overall plan stays consistent.

Does placing assets in a trust protect them from creditors?

Protection depends on the type of trust. Revocable trusts generally do not protect assets from creditors. Irrevocable trusts may provide protection, but only if structured correctly and funded well before any claims arise. Timing and drafting play a major role in determining protection.

Is a trust only useful for large estates?

No. Trusts are often used for reasons beyond estate size, such as privacy, probate avoidance, or long-term planning. Many families use trusts even when estate tax is not a concern. The usefulness of a trust depends on goals, not just asset value.

0 Comments