When someone passes away, families often assume property will transfer smoothly. Instead, many are pulled into a court process they didn’t expect, with delays, paperwork, and decisions made in public.

That process can stretch on for months. Costs add up quietly. During an already difficult time, families are left managing legal steps they never planned for.

One way people avoid this is to transfer property into trust while they are still alive. Doing so can change how property is handled later, but only if it is done correctly. Understanding the process matters.

I work with families and property owners who want clarity around these decisions before problems arise. This guide explains how the process works and what to think through before taking that step.

Types of Trusts for Property Transfers

Choosing the right trust type matters before you transfer property into trust. The structure you select affects control, flexibility, and long-term outcomes. Revocable and irrevocable trusts are the most common options, and each serves a different planning purpose.

Revocable Living Trusts (Most Popular)

A revocable living trust is the most common option for property owners. When property is transferred into a revocable trust, you retain full control and can sell, refinance, or amend the trust as circumstances change.

The Consumer Financial Protection Bureau notes that revocable living trusts allow individuals to maintain control of their assets during life, make changes as needed, and help avoid probate after death.

During your lifetime, you typically serve as trustee, so ownership and management feel the same. After death, property passes to beneficiaries privately, without court involvement, making this structure well suited for primary residences and straightforward estate plans.

Irrevocable Trusts (Medicaid/Asset Protection)

Transferring property into an irrevocable trust means you no longer control the property. Once it is placed in the trust, you usually cannot change your mind without the trustee’s approval.

This type of trust is often used for asset protection or long-term care planning. After the required waiting period, the property may be protected from certain claims. The trade-off is less flexibility, which makes this option better suited for long-term planning situations.

Special Cases: Land Trusts, QTIPs

Land trusts are sometimes used for rental properties to keep ownership details out of public view. When a land trust is combined with a Limited Liability Company (LLCs), extra reporting rules can apply, including newer federal disclosure requirements.

Qualified Terminable Interest Property (QTIP) trusts are often used in second marriages. They allow one spouse to use or receive income from the property during their lifetime, while deciding in advance who receives it later. These options work in specific situations, but most families do not need them.

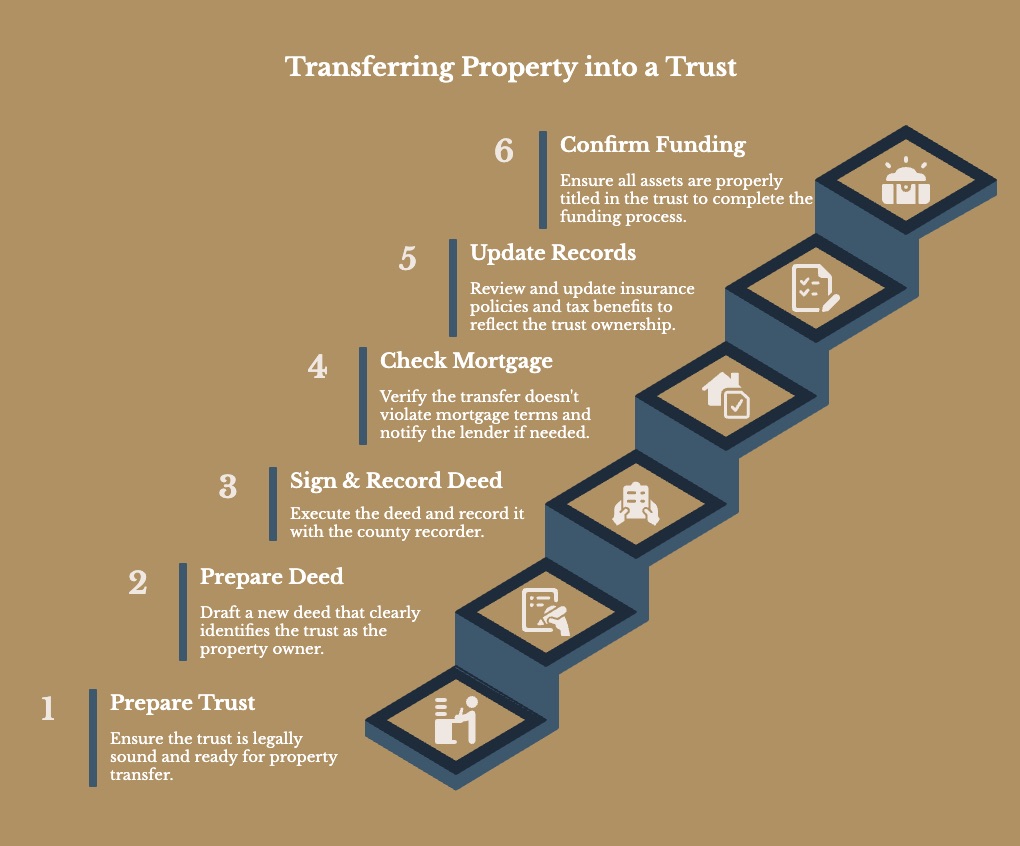

Step-by-Step Guide to Transfer Property Into a Trust

Transferring property into a trust means changing how the property is titled. Instead of being in your personal name, it is listed under the trust.

When this change is recorded properly, the property becomes part of the trust and avoids probate later.

Step 1: Make Sure the Trust Is Ready

Before any property is transferred, the trust itself must already exist.

Most people use a revocable living trust prepared by an estate planning attorney. The trust should name successor trustees and include instructions for incapacity.

If you already have a trust, it should be reviewed to confirm it authorizes property transfers and properly identifies how assets are to be held. Legal fees vary widely by state, attorney experience, and plan complexity.

Step 2: Prepare a New Deed

Real property is transferred into a trust by preparing and executing a new deed.

A quitclaim deed is typically used for trust transfers because it is simple and efficient, but it provides no title warranties. In some states, a warranty- or grant-type deed may be used when additional title assurances are desired.

The deed must clearly identify the trust as the owner, for example, “John Doe, Trustee of the John Doe Revocable Living Trust dated January 1, 2025.”

Step 3: Sign and Record the Deed

Once prepared, the deed is signed and notarized as required by state law.

It is then recorded with the county recorder or land records office where the property is located. If the deed is not recorded, the transfer may not be reflected in public records, which can create title issues and may undermine probate-avoidance goals.

Step 4: Check Your Mortgage

Federal law generally limits enforcement of a mortgage due-on-sale clause when property is transferred into an inter vivos (living) trust, provided the borrower remains a beneficiary and the transfer does not involve a change in occupancy rights.

Some lenders still request notification after the transfer. If the property is refinanced later, certain lenders or title companies may require the property to be temporarily deeded out of the trust and then transferred back into the trust after closing.

Step 5: Update Related Records

After the deed is recorded, related records should be reviewed and updated as needed.

Property insurance policies may need to list the trust as an additional insured. Homestead exemptions or property tax benefits are state-specific and may require additional filings to remain in effect after a trust transfer.

Title insurance treatment depends on the policy and underwriter. In some cases, an endorsement may be required to extend coverage. Some states also impose transfer or recording taxes, though exemptions may apply when no money changes hands.

Step 6: Confirm the Trust Is Fully Funded

Recording the deed completes the real estate transfer, but trust funding does not end there.

Bank accounts, investment accounts, and other titled assets should be reviewed regularly to confirm they are properly titled in the trust or have appropriate beneficiary designations. Using a funding checklist helps prevent assets from being unintentionally left outside the trust.

Probate Pain Points and Trust Advantages

A properly funded trust changes both cost and timing.

Probate costs are frequently estimated at 3%–7% of the estate value. Actual costs vary by state law, estate complexity, and the presence of disputes. Trust administration avoids many of these court-related costs by allowing property to be managed and transferred outside the probate process.

Timing also differs. Probate can delay access to property for months. With a trust, the trustee has authority to manage or distribute property immediately.

Privacy is another distinction. Probate filings become public record. Trust administration remains private, keeping financial and family details out of court files.

Emotional and Privacy Benefits

A trust can reduce stress during already difficult periods. Property does not become tied up in court, and responsibilities are clearly defined in advance.

Clear trust instructions help prevent confusion. When ownership and decision-making authority are established ahead of time, families are less likely to face disputes or rushed decisions.

Trust planning also supports incapacity protection. If illness or injury prevents you from managing property, a successor trustee can step in without the need for a guardianship or conservatorship.

Who Should Consider This?

Transferring property into a trust is often useful for:

- Homeowners with real estate valued above $150,000

- Families who want to keep financial matters private

- Real estate investors with multiple properties

- Blended families or second marriages

- Individuals planning for possible incapacity

For people who value control, privacy, and smoother transitions, transferring property into a trust can be a practical planning step.

2025 Regulatory Updates Impacting Transfers

Recent regulatory changes affect how some property transfers are reported. While the core benefits remain, anyone planning to transfer property into a trust should understand where additional disclosure may apply.

These rules do not eliminate the usefulness of trusts. They do add compliance steps in certain situations.

Corporate Transparency Act (CTA) and LLCs

Trusts themselves are not considered reporting companies under the Corporate Transparency Act. However, reporting rules can apply when a trust owns 25% or more of an LLC.

In those cases, the LLC must report certain people connected to the trust. This can include the trustee, the person who created the trust, and sometimes beneficiaries. These reports are filed with FinCEN and are required starting January 1, 2025.

When property is owned through an LLC that is held by a trust, this reporting reduces privacy. The filing is done online and does not involve a filing fee.

FinCEN Real Estate Reporting (Effective Dec 2025)

Separate rules apply to some real estate transfers. Certain non-financed residential transfers to trusts may require reporting details about ownership and the transaction itself.

These rules are scheduled to take effect in December 2025, although some areas have delayed enforcement until 2026. In many cases, the title company or closing agent will handle the required reporting.

Common Mistakes and How to Avoid Them

The following issues are among the most common problems that arise after property is transferred into a trust:

- Empty Trusts: This is one of the most common problems. A trust that is never funded does not avoid probate. Reviewing assets annually helps confirm everything is titled correctly.

- Refinancing Hassles: Some lenders require the property to be deeded out of the trust before refinancing. The property is typically transferred back into the trust afterward. Budgeting for recording fees and minor administrative costs can prevent delays.

- Irrevocable Remorse: Irrevocable trusts limit access and control. Starting with a revocable trust allows flexibility before committing to permanent transfers.

- Insurance Gaps: Insurance policies must be updated to reflect trust ownership. Failing to list the trust can create coverage issues if a claim arises.

- Tax Oversights: Homestead exemptions and property tax benefits may be lost after a transfer if they are not refiled. Prompt updates help preserve available protections.

How Early Planning Changes the Outcome

To transfer property into trust is to decide in advance how real estate is handled, who has authority, and when action can be taken. From correctly recording a deed to understanding newer reporting rules, each step matters. When done carefully, the result is continuity rather than delay.

If you are considering this step and want to avoid common mistakes, clear guidance makes a difference. Contact us today to receive practical guidance on timing, documentation, and proper execution.

Frequently Asked Questions

Do I still need a will if I transfer property into a trust?

Yes. A will is still needed even after you transfer property into a trust. A pour-over will directs any assets left outside the trust into it at death. This helps keep your estate plan aligned and prevents unintended probate for overlooked property.

Can I sell or refinance property after I transfer it into a trust?

In most cases, yes. With a revocable living trust, you typically remain in control as trustee. You can sell, refinance, or manage the property as you normally would. The trust changes how ownership is titled, not how the property functions during your lifetime.

Does transferring property into a trust affect my mortgage?

Usually, no. Federal law generally prevents lenders from enforcing due-on-sale clauses when property is transferred into a revocable trust and the borrower remains a beneficiary. Some lenders still require notice, so it’s important to review loan terms and notify the servicer when needed.

Will transferring property into a trust change my property taxes?

It can if follow-up steps are missed. After transferring property into a trust, homestead exemptions or property tax benefits may need to be refiled. Failing to update these records can result in higher taxes, even though ownership has not meaningfully changed.

What happens if I forget to transfer property into the trust?

Property that is not titled in the trust is not protected from probate. This is often referred to as an “unfunded” or “empty” trust. Regular reviews help ensure all intended assets are properly transferred so the trust works as planned.

0 Comments