10 Asset Protection Strategies for Business Owners 2024

10 Asset Protection Strategies for Business Owners

As a business owner, you know the importance of protecting your hard-earned wealth, but do you know how to maintain it over your family’s lifetime? In this guide, you’ll discover asset protection strategies for business owners that will help you make an informed decision.

Hi, I’m Nick. As an asset protection lawyer of 10+ years, I’ve worked on complex estates for multi-million dollar companies and small businesses. My knowledge on the subject is one of the best in the country. I hope you find a good takeaway with one of the strategies outlined in this article.

Key Takeaways

- Choose an appropriate business structure, like an LLC, to ensure liability protection and tax benefits while separating personal and business holdings.

- Create and maintain clear contracts outlining roles, responsibilities, and terms to minimize misunderstandings

- Invest in comprehensive business insurance to safeguard against unforeseen events and financial losses

- Utilize trusts to protect assets from creditors and distribute your resources to the ones that matter most to you

- Regularly review state laws to stay compliant across state lines, especially for military families who frequently move

Why Asset Protection Strategies Are Important

Asset protection strategies are helpful for safeguarding you against potential lawsuits and liabilities. Thoughts about securing wealth usually come about when you’ve been successful enough to have a legitimate concern about what happens after you’re gone or become incapacitated, but doesn’t need to be. Many small businesses for example could benefit from the simple strategies outlined in this article at the start of their business. Starting with a secure foundation for asset-protection is a great first step.

Choosing the Right Structure

The first step of any estate plan, small business or not, is choosing the right structure. There are several options available, but in most cases you want to create an LLC for your corporation.

How to structure LLC

There are several steps to structuring your LLC. Here are some steps you’ll have to make:

- Decide on Management

Will you manage the LLC yourself, or will you appoint a manager? This choice impacts operational flexibility and who can make decisions if you’re unavailable. - Choose a Name

Select a name that complies with state regulations and clearly represents your business. A compliant, unique name helps avoid legal issues down the road. - File the Articles of Organization

Submit your Articles of Organization to your state’s Secretary of State to officially form your LLC. This step legally establishes your LLC as a recognized business entity. - Consider an Operating Agreement

Even if your state doesn’t require it, an operating agreement defines member roles and responsibilities. This document supports long-term wealth preservation by clarifying ownership and decision-making authority. - Maintain Compliance

File annual reports, fulfill tax obligations, and keep accurate records of all business transactions. Staying compliant preserves the LLC’s liability shield, safeguarding your personal assets from business liabilities.

Keep Business and Personal Assets Separate

Keeping your business and personal assets distinctly separate is essential for protecting your financial interests and reducing liability risks. Start by opening dedicated bank accounts for your business and personal finances. This separation not only helps with accurate record-keeping but also leaves a digital footprint in case you get audited.

Now that your bank accounts are separated, avoid the mistake of using business credit card for personal expenses and vice versa. It might be tempting to write everything off as a write-off but it will come to bite you in the butt. All business income should flow directly into your business account, creating a clear financial trail.

Obviously when you draw your salary from your business bank account, make sure to record it as an official transaction. There’s more steps below on how to do that.

Documenting Your Salary for IRS

To make your salary an official record, follow these steps to ensure compliance and clear documentation:

- Set a Salary Structure

Determine a consistent salary amount or percentage of profits to pay yourself. If your business is an LLC or corporation, follow any state or IRS guidelines on owner compensation. - Issue Regular Payments

Transfer funds from your business account to your personal account on a regular schedule, just as you would with employee payroll. - Document Each Transfer

Record each payment as “Owner’s Draw” (for sole proprietors and LLCs) or “Salary” (for S Corporations or C Corporations) in your accounting software. Include the date, amount, and reason for the transfer. - Keep Supporting Documentation

Store receipts, bank statements, and accounting records showing each transaction. This paper trail is essential if you’re audited or need to show the IRS that you’re keeping business and personal finances separate. - File Tax Documents as Needed

If you operate as an S Corp or C Corp, ensure that your salary is properly recorded on payroll tax forms, like a W-2. Consult with an accountant to ensure compliance with payroll tax requirements.

Finally, when in doubt, review your financial practices with professionals, like accountants or estate planning attorneys to maximize your estate plan effectiveness and stay out of legal trouble. By maintaining this clear boundary, between personal expenses and business expenses, you greatly reduce potential risks of an IRS audit.

Create Contracts For Employees

Essential to every asset protection plan is taking preventative measures to reduce the chances of a lawsuit. Creating clear-cut contracts for employees not only prevents liabilities that jeopardize your businesses’ wealth, but creates operational excellence needed to scale.

Here are some clauses to keep in your employee contracts:

Confidentiality

A breach of confidentiality lawsuit could occur if one party discloses sensitive or proprietary information without permission. For example, if an employee shares client details or a company’s internal data with a third party, the company could sue for damages. Confidentiality agreements help protect sensitive information and can serve as grounds for legal action if violated.

Non-Compete Clause

If an employee or contractor violates a non-compete clause by working with a competitor within a restricted area or time frame, the former employer could sue for violating the agreement. For instance, if a former employee uses insider knowledge to attract clients away from their previous employer, the employer could file a lawsuit to prevent further competitive harm and potentially seek monetary damages.

Termination

If an employee is terminated in violation of the terms laid out in their contract (such as without the agreed-upon notice period or severance), they could file a wrongful termination lawsuit. The termination clause sets clear expectations around the conditions under which employment can end, helping reduce the risk of such disputes by clarifying mutual obligations.

Compensation

If an employer fails to compensate an employee or contractor as per the agreed terms, the individual could sue for unpaid wages or breach of contract. This could include salary, bonuses, commissions, or reimbursements for expenses that were promised. Clear compensation clauses help avoid misunderstandings, but if breached, employees or contractors can pursue legal action to recover what they are owed.

Intellectual Property

A lawsuit over intellectual property (IP) could occur if one party uses another’s IP without authorization. For example, if a contractor retains or uses designs, software, or proprietary knowledge developed for a company in other projects, the company could sue for IP theft or infringement. The IP clause clarifies ownership and usage rights, making it possible to enforce boundaries through legal action if necessary.

Arbitration

If a contract includes an arbitration clause but one party attempts to resolve a dispute through court rather than arbitration, the other party may sue for breach of the arbitration agreement. Arbitration clauses specify that disputes must be settled out of court, and ignoring this can lead to legal action to enforce arbitration, often as a way to honor the agreed-upon process for dispute resolution.

Dispute Resolution

If one party doesn’t follow the agreed dispute resolution process, such as skipping required negotiation or mediation steps, the other party might sue to enforce compliance with the dispute resolution clause. This clause is meant to structure how conflicts are resolved, so ignoring it can lead to additional litigation focused on enforcing those pre-determined steps, potentially avoiding court altogether.

Setting up contracts properly helps you to avoid potential civil cases that would affect your asset protection plan. Defense is the best offense when it comes to securing your wealth.

Separating Business and Personal Assets

Separating business and personal belongings is vital for minimizing liability risks and guaranteeing financial clarity. When you maintain a clear separation of business and personal holdings, you protect yourself from potential legal issues that could arise from mixing funds.

Start by establishing distinct bank accounts and credit cards for your business. This not only simplifies your accounting but also reinforces your business’s status as a separate entity.

Avoid charging personal expenses on business accounts and vice versa. Verify that all business revenue is deposited into your business account and that you pay yourself a salary from these funds. This practice creates a clear line between your business income and personal finances, greatly reducing the risk of personal liability for business debts.

Additionally, keep meticulous records of all transactions, as this can provide vital evidence should any disputes arise. By adhering to these strategies, you not only improve your financial management but also strengthen the legal protection surrounding your business.

Ultimately, the separation of business and personal assets isn’t just a good practice; it’s a strategic move that safeguards both your personal wealth and your business’s viability.

New Business Ventures Kept Separate

Just as you’d like to keep your personal and business assets separate, you should do the same if you operate multiple businesses. File separate LLCs for each one to create distinct legal entities. This separation limits liability, so if one business faces a lawsuit or debt, the others are shielded from risk. By establishing separate LLCs, you protect each venture’s assets, credit, and financial records, making it easier to manage obligations independently and avoid cross-liability issues. This also simplifies accounting when tax season comes around.

Purchase Business Insurance

Insurance acts as a financial safety net that protects your business from unexpected events like lawsuits, property damage, and employee injuries. Without adequate insurance, your personal and business assets could be at serious risk.

Here are the most common types of insurance you might need:

- General Liability Insurance

Protects your business from financial risk if someone gets injured or property is damaged. - Professional Liability Insurance

Shields your business from costly claims of negligence or mistakes in service delivery. - Property Insurance

Safeguards physical assets against risks like fire, theft, or natural disasters. - Workers’ Compensation Insurance

Covers employee injury expenses, reducing the risk of lawsuits and protecting your team. - Business Interruption Insurance

Compensates for lost income during disruptions, keeping your business financially stable.

Protecting Your Assets With Trusts

A trust is a legal arrangement that allows you to transfer ownership of your assets to a separate legal entity, managed by a trustee, which can serve as a powerful tool for asset protection.

By placing your assets in a trust, you create a legal shield that can help limit creditors’ and litigants’ access to your assets.

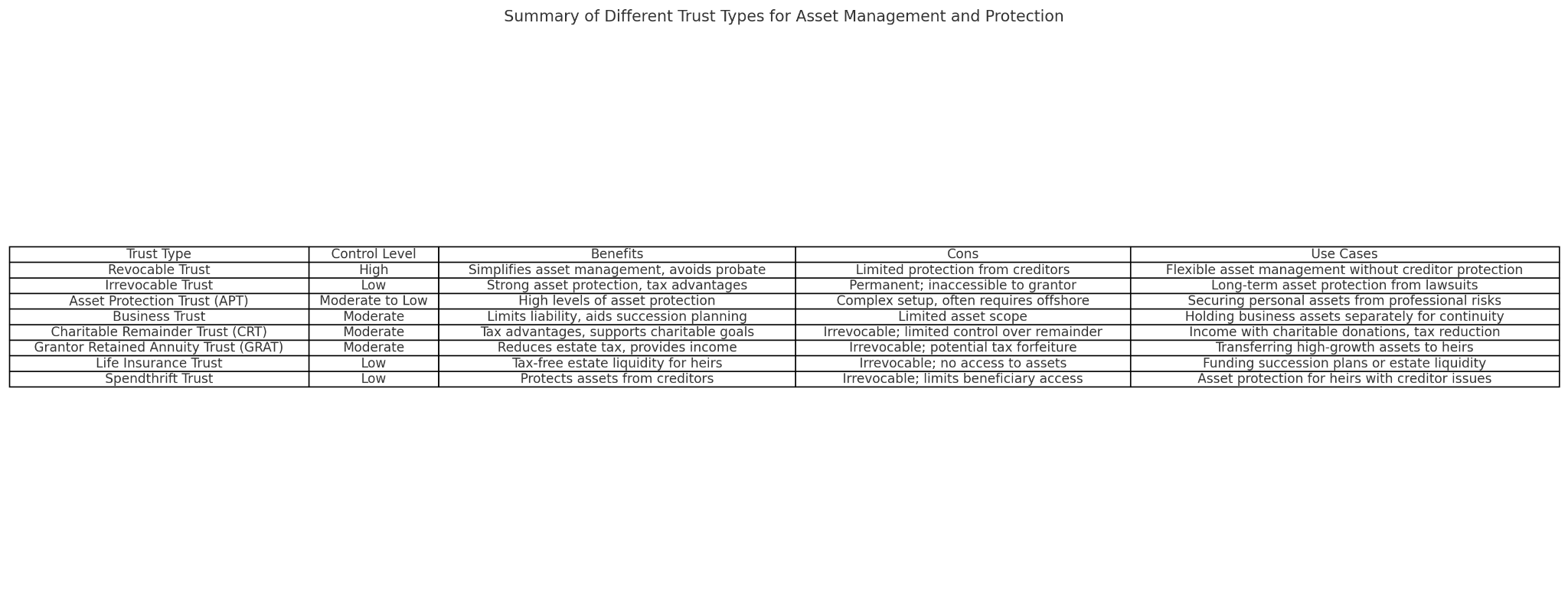

Understanding and managing the different types of trusts, such as irrevocable and asset protection trusts, is key to tailoring the right solution for your specific protection needs. Here are the most important ones for businesses to consider:

Revocable Trust

Allows the grantor (person who created the trust) to maintain control and make changes to the trust; useful for asset management but offers limited protection from creditors.

- Control: High (Grantor retains full control and can amend or dissolve the trust).

- Benefits: Simplifies asset management, avoids probate, allows flexibility to adapt over time.

- Cons: Limited asset protection; assets are still accessible to creditors and for lawsuits.

- Use Cases: Business owners wanting flexible asset management without immediate asset protection concerns.

Irrevocable Trust

Provides stronger asset protection, as assets are permanently removed from the grantor’s ownership, making them less accessible to creditors and lawsuits.

- Control: Low (Grantor relinquishes control; trust terms cannot be changed).

- Benefits: Strong asset protection, often provides tax advantages, shields assets from creditors and lawsuits.

- Cons: Permanent; assets are locked in and inaccessible to the grantor.

- Use Cases: Owners seeking to protect assets long-term from creditors, lawsuits, or estate taxes.

Asset Protection Trust (APT)

Specifically designed to protect assets from creditors and legal claims, often established in jurisdictions with strong asset protection laws.

- Control: Moderate to Low (Varies by jurisdiction; grantor may retain limited control if set up offshore).

- Benefits: Offers high levels of asset protection from creditors and legal claims, often structured to withstand legal challenges.

- Cons: Complex to set up; high legal and administrative fees, sometimes requires offshore arrangements.

- Use Cases: Business owners facing high liability risks who want to secure personal assets from professional exposure.

Business Trust

Holds business assets separately from personal assets, which can limit liability and facilitate succession planning or business continuity.

- Control: Moderate (Trustee or business manager controls the trust’s assets).

- Benefits: Limits personal liability by separating business and personal assets, helps with succession planning.

- Cons: Management of assets is limited to the trust’s scope, requires formal structure and compliance.

- Use Cases: Used to hold business assets separately for liability protection and business continuity planning.

Charitable Remainder Trust (CRT)

Allows a business owner to transfer assets to a trust that generates income and eventually benefits a charity, offering tax advantages and asset protection.

- Control: Moderate (Grantor retains income benefits but can’t alter remainder interest).

- Benefits: Provides tax advantages, allows grantor to receive income for life or a set period, supports charitable goals.

- Cons: Irrevocable once set up; limited control over remainder assets.

- Use Cases: Business owners seeking income while also making charitable donations and reducing tax burdens.

Grantor Retained Annuity Trust (GRAT)

Allows the business owner to transfer assets to beneficiaries while retaining income for a set period, providing estate tax benefits and minimizing transfer costs.

- Control: Moderate (Grantor retains income for a specified term but transfers remaining interest).

- Benefits: Reduces estate tax liability, provides predictable income, potentially benefits heirs tax-efficiently.

- Cons: Irrevocable; if grantor dies during the trust term, estate tax savings may be forfeited.

- Use Cases: Business owners wanting to transfer high-growth assets to heirs while retaining income temporarily.

Life Insurance Trust

Holds life insurance policies for business owners, allowing proceeds to pass to heirs tax-free, which can help fund business succession or estate planning.

- Control: Low (Trust is irrevocable; grantor gives up control over the life insurance policy).

- Benefits: Removes life insurance proceeds from taxable estate, provides liquidity for heirs, aids in business succession.

- Cons: Irrevocable; once assets are in the trust, the grantor can’t access them.

- Use Cases: Owners using life insurance to fund business succession plans or estate liquidity for family members.

Spendthrift Trust

Protects assets from beneficiaries’ creditors by limiting their ability to transfer or assign interest in the trust, providing long-term asset protection

- Control: Low (Beneficiaries have limited access and cannot assign interests).

- Benefits: Protects trust assets from beneficiaries’ creditors, provides long-term financial management.

- Cons: Irrevocable; restrictions on beneficiary access can limit flexibility.

- Use Cases: Ideal for protecting assets for heirs who may have creditor issues or lack financial management skills.

If you’d like to get more information on how a trust can help protect your business assets and which one is best for you, we highly recommend booking a free consultation at Birch Grove Legal. We’ll walk you through the pros and cons of each trust and personalize it to your unique situation.

Transfer Property Rights to Someone You Trust to Protect Against Creditors

Transferring property rights to a trusted individual or entity focuses on protecting property from creditors, managing tax implications, and/or protecting against risks and liabilities. Note property here means financial assets, intellectual property, business interests, and digital assets.

Here are four key points to evaluate:

- Choose the Right Person or Entity

Select a trustworthy individual or entity (such as a trust) to hold the property. Their reliability is crucial for maintaining the safety and integrity of your assets, so vet this person thoroughly to ensure they’ll respect your intentions. - Legally Document the Transfer

Properly document the transfer through legally binding agreements to prevent misunderstandings or disputes about ownership. Clear documentation establishes legal boundaries, confirming your wishes and helping to protect the asset if challenged. - Evaluate Tax Implications

Transferring assets can trigger tax consequences, such as gift taxes, capital gains taxes, or inheritance taxes, depending on the property type and transfer method. Consulting a tax advisor will help you navigate these potential impacts and avoid unexpected liabilities. - Consider Retaining Some Control

Think about maintaining some control over the asset, like setting up a life estate or retaining certain rights in a trust. This approach allows you to continue benefiting from the asset (e.g., receiving income or use rights) while protecting it from creditors, ensuring a balanced approach to asset security and personal benefit.

Use Prenupitial Agreement to Protect Family Business

When you’re part of a family business, the thought of personal relationships impacting your business can be a real worry. Without proper safeguards, a divorce or marital dispute could put your business assets at risk, potentially threatening the legacy and stability you’ve worked hard to build.

Imagine a scenario where a spouse claims partial ownership or financial interest in your family business during a separation. Suddenly, your business assets, profits, and even management decisions could be up for debate in a courtroom. Not only does this add financial risk, but it also brings stress, tension, and the potential for business instability—impacting both your family and the business’s future.

A prenuptial agreement can be a proactive solution to prevent these risks. By clearly outlining ownership and control of business assets, a prenup allows you to specify which parts of your business remain separate property, helping to safeguard its value and stability. This agreement can also define how profits and losses are managed, so everyone is clear on financial expectations. With the guidance of a legal expert, you can create a tailored prenup that meets your unique needs, ensuring your family business is protected while fostering transparency and a strong foundation with your spouse.

Apply for Trademarks, Patents, Copyrights

With technology advancing everyday, claiming intellectual property is crucial for maintaining your business assets and is a key aspect of asset protection strategies for businesses.

Here are four key benefits of securing your intellectual assets:

- Control over your brand: Trademarks give you exclusive rights to your brand identity, preventing others from using similar marks that could confuse consumers and steal your potential customers.

- Control over your product: If you’re the first in the market to discover a game-changing product, then you likely already have considered getting a patent. Patents can notably increase your business’s valuation by offering proprietary technologies or processes that competitors can’t replicate.

- Legal recourse: In any case that anyone does steal your IP or harms your brand identity, you have legal documents on your side to protect your business.

- Market Position: Strong trademark protection can elevate your market position and build consumer trust, leading to increased sales.

We’d recommend consulting with an attorney that specializes in estate planning to secure your business assets from potential threats. They will help you ensure all your documents are set up correctly to mitigate risk down the road.

Invest Your Profits for Maximum Gains

Leaving profits in your business bank account might seem like the conservative, right thing to do, but it also has its downsides. Withdrawing profits regularly can protect your wealth from unnecessary vulnerabilities and maximize financial opportunities.

Here’s why reconsidering this approach can benefit your long-term wealth:

- Creditor Protection: Retained profits are vulnerable to creditor claims if your business faces financial issues, which could erode your personal wealth.

- Legal Exposure: Leaving profits in the company can increase legal risks, making your business assets more accessible in the event of lawsuits.

- Tax Optimization: Excessive retained earnings may lead to unfavorable tax consequences, potentially increasing your personal tax burden.

- Enhanced Liquidity: Regularly distributing profits improves cash flow flexibility, allowing you to diversify investments and access funds for personal opportunities or emergencies.

Strategically withdrawing profits protects your assets, reduces dependency on the company’s performance, and strengthens your overall wealth management plan,

Which Asset Protection Strategy Is Right For You?

Incorporating these ten asset protection strategies can greatly enhance your business’s security and profitability in this generation and into the next. By carefully choosing your business structure and maintaining clear separations between personal and business assets, you minimize risks. Contracts and thorough insurance provide further protection. If you have any questions about which strategy is best suited for your particular business, feel free to book a consultation with our team. We’ve worked on countless accounts to maximize profits while protecting our clients from pitfalls and liabilities. Book a free consultation today!

[trustindex no-registration=google]

0 Comments